Understanding Capital Growth vs. Rental Yield: Which Should You Prioritise?

Understanding Capital Growth vs. Rental Yield: Which Should You Prioritise?

Example:

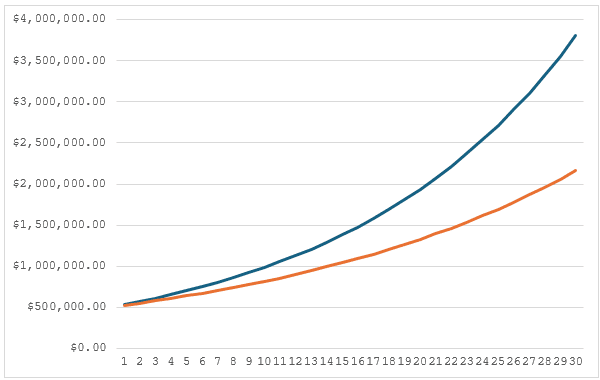

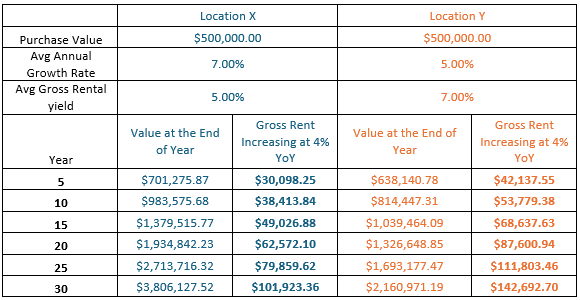

One graph that helps our customers choose one between the other is a scenario where we compare 2 properties – both worth $500K today – one in an area which historically has been growing by 7% on average over the last 20 years and has a 5% rental yield while the other is at a location which has historically grown by 5% over the 30 years and has a rental yield of 7%.

This is why choosing the right strategy is crucial to property investments. The difference may be negligible in the short run but the difference can be quite substantial when compounded over time.

So, what’s your choice? Capital Growth or Better Cashflow at the cost of capital growth? Don’t go by what someone says, look at the numbers, see what you can sustain comfortably. Speak to an investment savvy buyer’s agent, mortgage broker, financial planner or accountant to get a better insight. Call PBA or book in a free consultation and we’ll try to help the best we can, or direct you to a professional whom we feel may be in the best position to help you.

How Property Buyers Advisory (PBA) Can Help

Navigating the complexities of capital growth versus rental yield requires expertise and strategic insight. This is where Property Buyers Advisory (PBA) excels. As seasoned buyer's agents, we specialize in helping investors make informed decisions that align with their financial goals.

Property Buyer’s Advisory's Role in Your Investment Strategy:

1. In-Depth Market Analysis:

PBA conducts comprehensive market research to identify high-growth areas and rental yield hotspots. Our insights help you choose the right property at the right location to match your investment strategy.

2. Tailored Investment Plans:

We understand that every investor’s situation and journey is unique. PBA crafts personalized investment plans based on your goals, risk tolerance, and timeline, ensuring that your property portfolio aligns with your wealth objectives.

3. Access to Exclusive Opportunities:

PBA has access to off-market and pre-market properties and exclusive deals that might not be available to the general public. This gives you a competitive edge in securing high-potential investments. This does not mean that we don’t look at properties which are on the market. All options are considered to ensure that we help our clients with best results.

4. Expert Negotiation:

We focus is securing the best possible terms and/or prices for your investments. This helps maximize your returns, whether you prioritize capital growth or rental yield. We achieve this through:

· In-depth market research: We have a comprehensive understanding of current market trends and property values, allowing us to negotiate from a position of strength.

· Strategic negotiation tactics: We employ proven negotiation strategies to secure the best possible terms and prices for your specific investment goals.

· Strong communication and relationship building: We build strong relationships with the selling agents, fostering trust and creating a collaborative environment for successful negotiations.

5. Ongoing Support and Guidance:

Property investment is an ongoing journey – which is why PBA provides continuous support and updates, helping you adapt your strategy as market conditions or situation undergo change.

Your Path to Property Investment Success

Understanding the balance between capital growth and rental yield is crucial for any property investor. Whether you aim for long-term wealth accumulation or steady cash flow, aligning your strategy with your financial goals is key.

At Property Buyers Advisory, we are dedicated to guiding you through this complex landscape with expertise and personalized support. Ready to embark on your property investment journey? Contact PBA today and let us help you achieve your investment dreams