Property Prices, Interest Rates and Inflation: What 2026 Is Shaping Up to Look Like — and What Investors Should Do Now

There’s a strange tension in the Australian property market right now.

On one hand, interest rates have paused. Inflation is easing — but not disappearing.

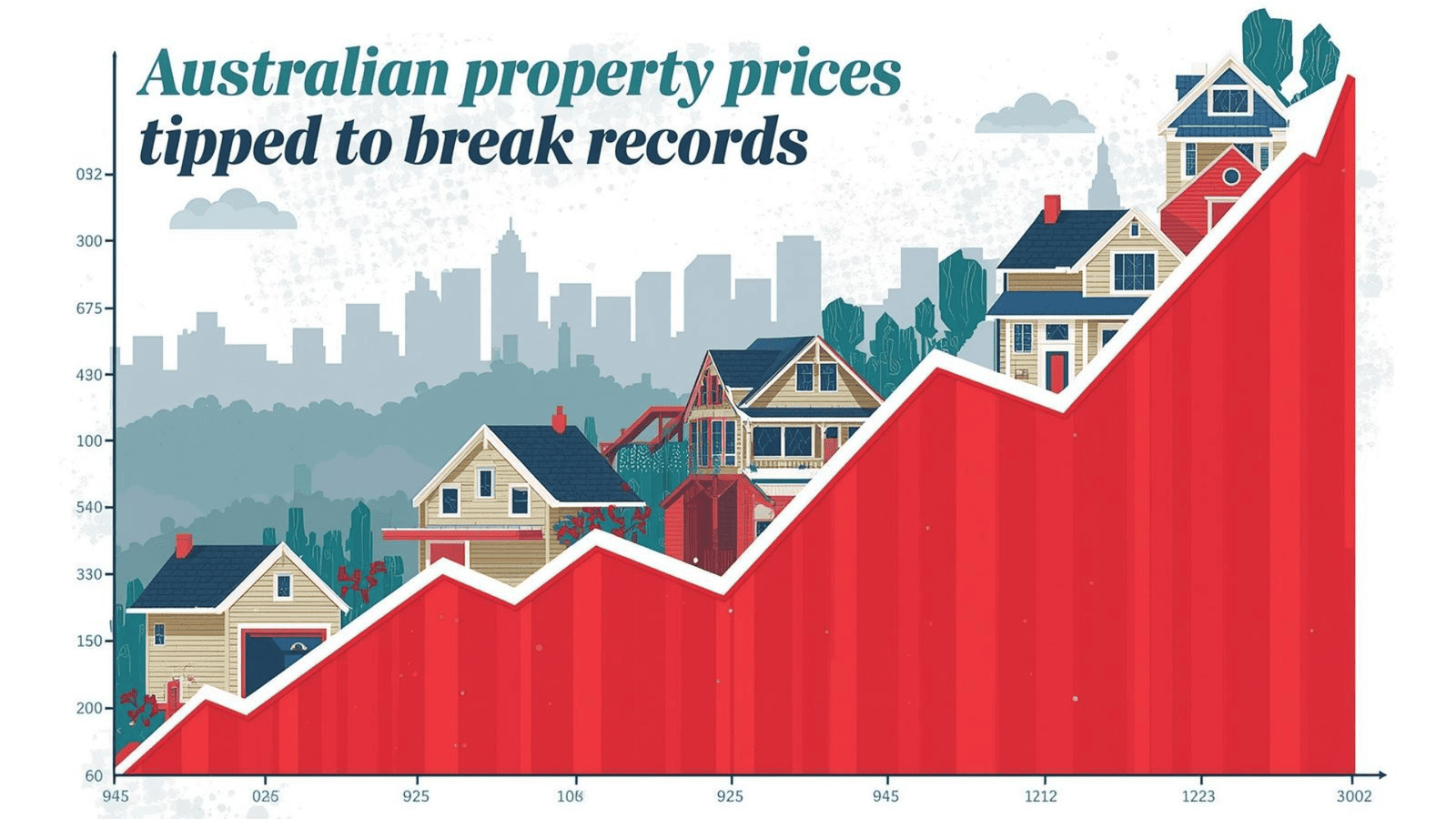

On the other hand, property prices are being tipped to break records again in 2026.

For many would-be investors, this creates confusion.

Shouldn’t prices slow if rates are high?

If inflation is “sticky”, shouldn’t buyers pull back?

And if everyone keeps saying prices will rise… is now the time to act, or the time to be cautious?

As a buyer’s advocate, these are the conversations I’m having daily. And the answer, as always in property, isn’t black and white. It sits somewhere in the middle — shaped by supply, demand, psychology, and long-term fundamentals.

Let’s unpack what’s actually happening, what the data is telling us, and how investors — especially first-timers — should be thinking about 2025 and beyond.

The Big Headlines: Prices Rising Again Despite Rate Uncertainty

According to recent forecasts reported by realestate.com.au and Broker News, Australian property prices are expected to continue climbing into 2026 — potentially reaching new record highs — even as interest rate uncertainty lingers.

That surprises a lot of people.

We’ve been conditioned to believe higher rates automatically mean falling prices. And historically, that’s sometimes been true. But property markets don’t respond to rates in isolation. They respond to imbalances.

Right now, Australia has one of the most severe housing supply shortages in decades.

Construction activity has slowed. Builders are under pressure. Migration remains elevated.

Rental vacancies are tight. And demand hasn’t gone away — it’s just been delayed.

When demand builds quietly while supply stays constrained, prices don’t fall dramatically.

They pause. Then they move again.

That’s what many analysts believe we’re seeing now.

The RBA Pause: Relief, But Not a Green Light

The RBA’s decision to pause rates has provided psychological relief to the market. Not euphoria — relief.

Buyers are no longer asking, “How much higher will rates go next month?”

They’re asking, “Can I plan again?”

And that shift matters.

When people can plan, they act. Not all at once. Gradually. Carefully. But they re-enter the market.

Importantly, a pause doesn’t mean rates are suddenly low. Borrowing is still more expensive than it was a few years ago. Serviceability remains a hurdle. But stability changes behaviour — and behaviour moves markets.

From an investor’s perspective, this is less about timing the exact bottom and more about recognising when confidence slowly returns.

Inflation Is Slowing… But It’s Not Gone

Yes, Australia’s inflation rate has slowed. But core inflation remains sticky.

That matters because inflation, even at lower levels, pushes up:

- construction costs

- labour costs

- land values

- rents

- replacement costs

Property is, at its core, a real asset. Over long periods, real assets tend to move with inflation — not immediately, not smoothly, but persistently.

This is why many long-term investors view property as a hedge. Not because prices rise every year. But because over time, replacement becomes more expensive, and scarcity becomes more valuable.

That doesn’t mean “prices only go up.”

It means well-located property tends to hold value and grow over cycles, especially when supply can’t keep up.

So Why Are Prices Expected to Break Records?

In my experience, price growth usually comes from a combination of four things — and right now, all four are present:

1. Chronic Supply Shortages

Australia simply isn’t building enough homes. Planning delays, construction costs, and builder insolvencies are compounding the issue.

2. Strong Population Growth

Migration has returned faster than housing supply can respond. More people need somewhere to live — whether renting or buying.

3. Rental Pressure

Low vacancy rates are pushing rents higher. Higher rents improve investor cash flow, making property more attractive again.

4. Pent-Up Demand

Many buyers sat on the sidelines during rate rises. They didn’t disappear. They waited. When these forces combine, price growth doesn’t need rate cuts to resume. It just needs enough confidence.

What This Means for Investors Asking “Should I Buy Now?”

This is the question behind most conversations I have with new investors.

And the honest answer is this:

There is rarely a “perfect” time to buy property. But there are periods when acting thoughtfully makes sense.

Right now feels like one of those periods — if you approach it correctly.

Here’s what I’d encourage first-time investors to consider.

Timing vs Strategy: The Mistake Most People Make

Many people wait for:

- lower rates

- clearer signals

- cheaper prices

- certainty

But property rarely offers certainty. And by the time it does, prices have usually moved.

The investors who do well long-term aren’t the ones who buy at the “perfect” moment. They’re the ones who:

- buy within their means

- choose locations with fundamentals

- hold through cycles

- manage risk

In other words, they prioritise strategy over timing.

Why “Waiting” Can Be Risky Too

Waiting feels safe. But it carries its own risks.

If prices rise 5–8% while you wait for clarity, your deposit target moves further away.

If rents rise while prices rise, investors who already own benefit — and renters fall further behind.

If borrowing capacity improves and more buyers re-enter the market, competition increases.

Doing nothing is still a decision. Sometimes the most calculated move is a measured step forward.

What a Calculated Risk Looks Like in Property

Taking a calculated risk doesn’t mean rushing. It means preparing.

It looks like:

- understanding your borrowing capacity

- building buffers

- choosing suburbs with diverse employment bases

- avoiding speculative “hotspots”

- focusing on long-term demand drivers

- buying something you can hold comfortably

This is especially important in a market where prices are expected to rise gradually, not explode overnight.

Steady growth rewards discipline, not panic.

Not All Markets Will Perform the Same

One important nuance often missed in headlines: Australia doesn’t have one property market.

Some cities and suburbs will outperform. Others will stagnate.

Markets with:

- infrastructure investment

- population inflows

- limited new supply

- strong rental demand

are likely to see better outcomes.

Markets driven purely by hype or affordability alone are more fragile.

This is where local knowledge and research matter far more than national headlines.

My Perspective as a Buyer’s Advocate

When clients ask me whether now is a good time to invest, I rarely give a simple yes or no.

Instead, I ask:

- What are you trying to achieve?

- What’s your time horizon?

- How comfortable are you with short-term uncertainty?

- Can you hold the property if conditions tighten?

If the answers align, then yes — this environment can present opportunity. Not because prices will definitely surge tomorrow.

But because long-term fundamentals remain intact, and early movers often benefit most when confidence returns.

A Note on Psychology (Because It Matters More Than People Admit)

Markets move on numbers.

But decisions are driven by psychology.

Right now, we’re in a transition phase:

- fear has eased

- confidence hasn’t fully returned

- uncertainty remains

This is often where the best decisions are made — quietly, without fanfare.

By the time optimism dominates headlines, many opportunities have already passed.

So… What Should You Do Next?

If you’re a first-time investor watching all of this unfold, here’s my grounded advice:

- Don’t rush — but don’t ignore what’s happening

- Educate yourself on market drivers, not just rates

- Focus on locations, not headlines

- Prepare financially before emotionally committing

- Seek guidance if you’re unsure — mistakes are expensive

Property rewards preparation far more than prediction.

Final Thoughts

The outlook for 2026 suggests continued pressure on housing prices, driven by supply shortages, population growth, and improving confidence — even without aggressive rate cuts. That doesn’t mean everyone should buy. But it does mean doing nothing without understanding the consequences can be just as risky.

If you’re trying to decide whether investing now makes sense for you — and how to do it without overextending — I’m happy to help you think it through.

Sometimes all it takes is a calm, informed conversation to turn uncertainty into clarity.

#AustralianProperty #PropertyMarketAustralia #PropertyInvesting #InvestmentProperty #PropertyOutlook #PropertyPrices #RealEstateAustralia #PropertyTrends #HousingMarketAustralia